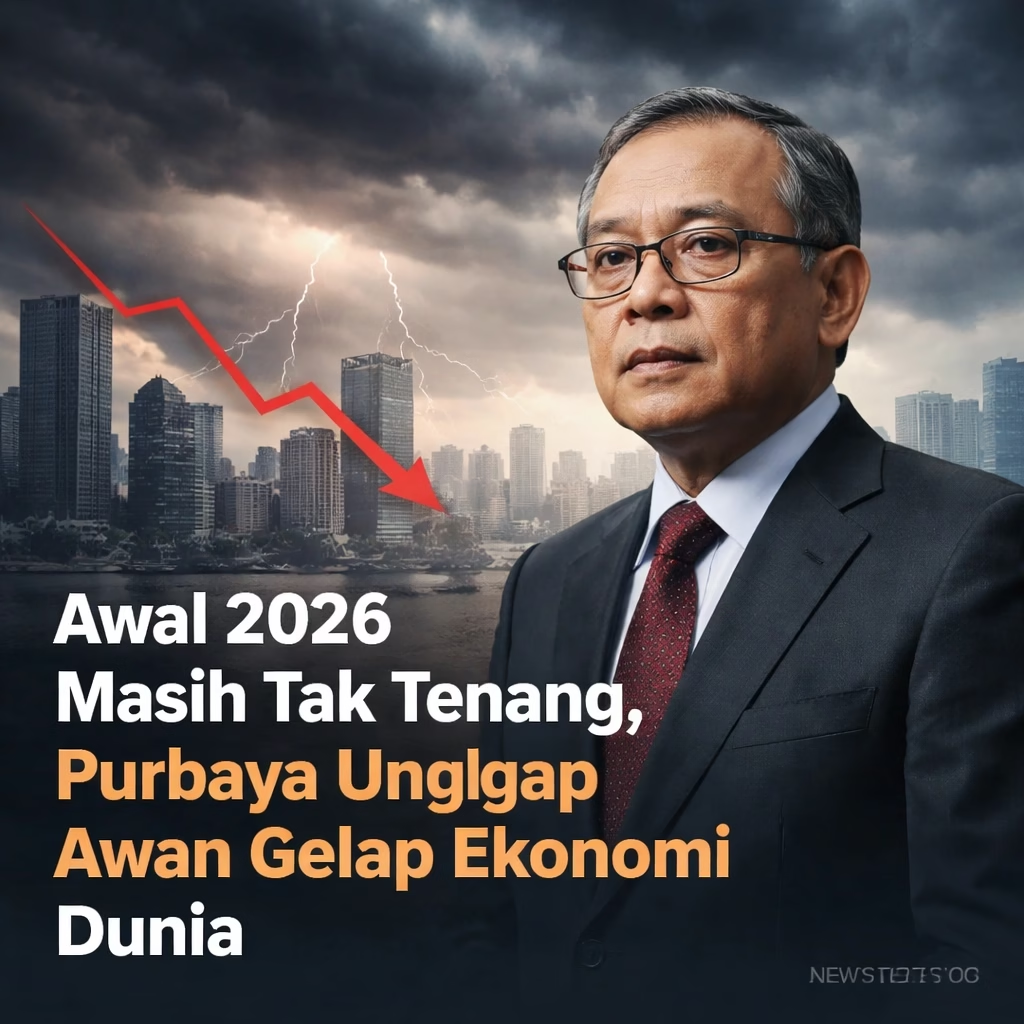

Global Economic Storm Brewing? Expert Warns of Lingering Uncertainty

Jakarta, Indonesia – Early 2026 presents a challenging outlook for the global economy, according to economist Purbaya Triadi. Speaking at a seminar in Jakarta on January 26, 2026, Purbaya highlighted several factors contributing to a persistent "cloud of uncertainty" despite recent positive indicators in some sectors.

Background: A Rocky Road to Recovery

The global economy has been navigating a complex recovery since the sharp downturn experienced in 2022. Inflation, initially a major concern, has cooled in many developed nations, although remains above pre-pandemic levels in some areas. Central banks, including the US Federal Reserve and the European Central Bank, have aggressively raised interest rates to combat inflation, a move that has impacted borrowing costs globally.

Geopolitical tensions, particularly the ongoing conflict in Ukraine and increasing trade friction between the United States and China, have also significantly influenced economic performance. Supply chain disruptions, while easing, continue to present vulnerabilities. The rapid adoption of artificial intelligence (AI) is creating both opportunities and anxieties regarding labor markets and productivity.

Key Developments: A Mixed Bag of Signals

Recent data reveals a mixed picture. While the US economy has shown resilience, with continued job growth, concerns persist about potential recessionary pressures in the latter half of 2026. The Eurozone faces ongoing challenges related to energy security and high inflation, hindering robust growth. China's economic recovery, after easing COVID-19 restrictions in late 2022, has been uneven, with property sector difficulties posing a significant risk.

Furthermore, rising sovereign debt levels in several emerging economies are a cause for concern. Increased borrowing costs, driven by higher interest rates, are making it more difficult for these nations to manage their debt burdens, increasing the risk of financial instability. The volatility in commodity prices, particularly oil and gas, adds another layer of complexity to the global economic forecast.

Impact: Who Feels the Pinch?

The potential economic slowdown will likely impact a wide range of stakeholders. Businesses, particularly those reliant on global supply chains, face increased costs and uncertainty. Consumers are grappling with persistent inflation and higher borrowing costs, impacting purchasing power. Developing nations are particularly vulnerable, as rising interest rates and a stronger US dollar increase the cost of servicing debt.

The agricultural sector is also at risk. Climate change-related events, such as droughts and floods, are disrupting crop yields and contributing to food price volatility. This poses a direct threat to food security, especially in vulnerable regions of Africa and Asia. Furthermore, the AI revolution is expected to displace workers in certain sectors, requiring significant investment in retraining and upskilling initiatives.

Emerging Markets: A Double-Edged Sword

While some emerging markets are benefiting from increased demand for commodities, others are facing significant headwinds. High debt levels, currency volatility, and political instability are creating a challenging environment for investment and growth. The ability of these nations to navigate these challenges will be crucial in shaping the global economic outlook.

What Next? Expected Milestones

The next few months will be critical in determining the trajectory of the global economy. The Federal Reserve's monetary policy decisions, scheduled for March and May 2026, will have a significant impact on global interest rates. The International Monetary Fund (IMF) is expected to release its updated World Economic Outlook report in April 2026, providing a comprehensive assessment of the global economic outlook.

Geopolitical developments, particularly the evolution of the conflict in Ukraine and US-China relations, will also play a key role. The pace of AI adoption and the effectiveness of government policies aimed at mitigating its potential negative impacts will be closely watched. The World Bank's annual Spring Meetings in May 2026 will provide a platform for discussions on global development challenges and potential solutions.

Purbaya emphasized the importance of proactive policy measures to mitigate the risks of a potential slowdown. This includes coordinated efforts by governments and central banks to address inflation, support vulnerable populations, and promote sustainable economic growth. He cautioned against complacency, stating that the "cloud of uncertainty" is likely to persist for some time.