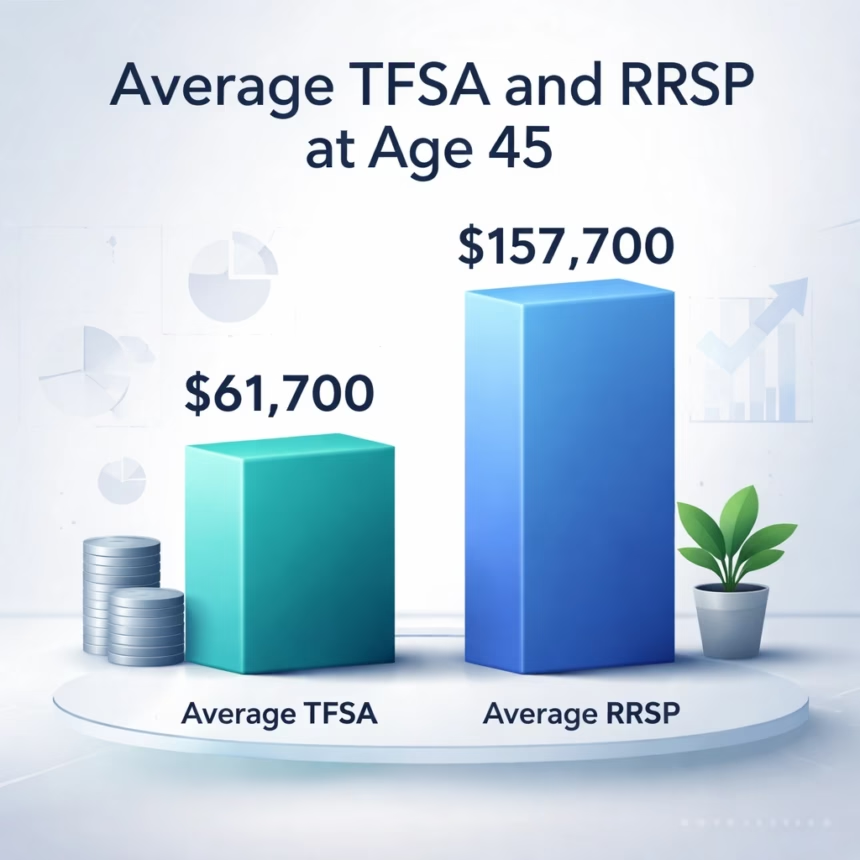

Your Retirement Savings: Where Do You Stand at 45?

Across Canada, many are reaching their mid-40s and contemplating their retirement readiness. New data reveals the average amounts Canadians have saved in their Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSP) at age 45. Understanding these averages can help individuals assess their own financial position and plan for the future.

Background: Building a Foundation

The TFSA was introduced in 2009 as a way for Canadians to save for various goals, including retirement. It offers tax-free growth and withdrawals, making it an attractive savings vehicle. RRSPs, established much earlier in 1980, provide tax deductions on contributions, deferring taxes until retirement. Historically, these plans have been cornerstones of Canadian retirement strategies.

For decades, financial advisors have recommended consistent contributions to both TFSAs and RRSPs to maximize long-term savings. The ideal savings rate varies depending on individual circumstances, income, and retirement goals, but regular contributions are generally considered essential.

Key Developments: Evolving Landscape

Several changes have influenced retirement savings in recent years. The TFSA contribution room has increased consistently, providing more flexibility for savers. The RRSP Home Buyers' Plan (HBP) and Lifelong Learning Plan (LLP) offer specific options for first-time homebuyers and those pursuing education, respectively. These changes aim to make retirement savings more accessible and adaptable to various life stages.

Furthermore, the COVID-19 pandemic impacted savings patterns. During lockdowns, many Canadians reduced spending and increased their savings, particularly in TFSA accounts. However, economic uncertainty and inflation have also presented challenges, requiring careful financial planning.

Impact: Who’s Feeling the Pressure?

The average savings figures paint a picture of varying levels of retirement preparedness. While some Canadians have built substantial nest eggs, others are lagging behind. Factors such as income, employment stability, and debt levels significantly influence retirement savings. Younger individuals entering the workforce may have less accumulated savings compared to those nearing retirement.

Regional differences also exist. Provinces like Alberta and Ontario often have different average incomes and cost of living, which can impact savings potential. Those in lower-paying jobs or facing financial hardship may struggle to save consistently. The rising cost of housing and childcare further complicates retirement planning for many Canadians.

What Next: Looking Ahead

Looking ahead, several trends are expected to influence retirement savings. Continued inflation will necessitate adjustments to savings strategies. Increased awareness of financial planning is encouraging more Canadians to seek professional advice. Government policies related to retirement benefits and tax incentives will also play a role.

Potential Changes to Pension System

The federal government is currently reviewing the Canada Pension Plan (CPP) and Old Age Security (OAS) to ensure their long-term sustainability. Potential changes could affect the amount of income Canadians receive in retirement from these sources, potentially increasing the need for personal savings.

The Role of Financial Technology

Fintech companies are playing an increasingly important role in retirement planning, offering tools and platforms for automated savings, investment management, and financial advice. These innovations could make retirement planning more accessible and affordable.

Ultimately, proactive planning and consistent saving are crucial for ensuring a comfortable retirement. Regularly reviewing financial goals and seeking professional guidance can help Canadians navigate the complexities of retirement savings and achieve their financial aspirations.